Mega yacht

Mega yacht

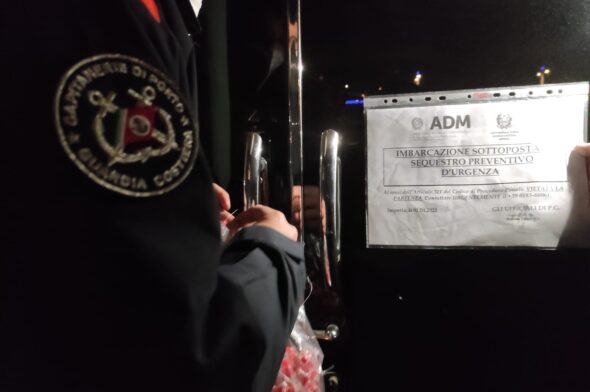

The gigayacht Scherazade has been seized by the Guardia di Finanza. Is it Putin’s? The mystery continues…

- 10 May 2022

Is seizing Russian super yachts legal or not? Yes, because Italy is obligated to do it, as part of its European and international duties.

In these days, there has been a lot of talk about the super yachts belonging to Russian oligarchs, searching the world for countries where the international sanctions applied to Russia are not followed, like in the case of Turkey, where the mega yacht belonging to Roman Abramovich is docked. Seizures have also taken place in Italy where, however, they are technically called “freezing” of assets.

In order to clarify what is happening, we spoke to Simone Moretti, a lawyer working for the law studio Boglione. Studio legale Boglione, with offices in Milan, Genoa and Rome, was founded in 1973 and is specialised in legal assistance in navigational, transport and insurance law, with a particular speciality in international topics and common law.

Mr Moretti, the newspapers have mentioned, seizure, sequestration and freezing: can you clarify? What is the actual legal action that has taken place here?

The provision being followed here is Leg. Dcr. Num 109/2007 regarding the prevention, obstruction and repression of terrorist financing and the activities of countries that threaten international peace and security. The decree recognises the 2005/60/CE directive (now replaced by UE 2015/849 directive) and is implementing Resolution num.1373/2001 of the United Nations Security Council, created during the International Convention against Terrorist Financing on 8 December 1999.

Based on these regulations, the UN and European Union create “consolidated lists” wherein are listed the names of subjects involved in terrorist organisations or, like in this case, individuals who are considered to be promoting or financing countries threatening international peace and security. The people on the list can then undergo the freezing of funds and assets, which is implemented at a national level.

What is special about this tool is that is is not a judicial order, but the emission of a penalty order issued by the Ministry of Economy and Finance, based on proposals received from the Committee of Financial Security (CSF), an organisation made up of nominated members from a number of different governmental and administrative organisations working within the Ministry, chaired by the Director-General of the Treasury.

Leg. Dcr. 109/2007, initially created for sanctions post September 11th, was slowly adapted and used to issue sanctions that were later adopted by international bodies. In this particular case, the tools in the decree are used by the Italian government to implement to sanctions created by the European Union through a series of PESC decisions (Foreign Policy and Community Security) and the consequent regulations implemented by the Council ( starting with decision num. 2022/327 and regulation for implementation num. 2022/330 of 25.2.2022 and following) implemented in EU Provision num. 269/2014 whose appendix contains a list of physical and juridical persons affected by the sanctions.

Are these legitimate regulations? If an owner affected by the sanctions wanted to contest the provisions, would they be able to have it repealed?

These are provisions which are founded in primary level law, in compliance with obligations taken on by our country both internationally and in Europe.

The legitimacy of the sanctions for international law is the subject of much debate and will not find a solution at an intergovernmental level, except through a hypothetical constitutional union or the Court of Justice. On an internal level, the listing provision is subject to legitimacy parameters provided by EU law and the general principles of our system.

The Mef sanctioning provision, which calls for freezing of assets, can be contested in front to the Tribunale di Roma, which has exclusive jurisdiction (before 4.7.17 it was TAR Lazio) in line with Art/ 14 of the decree.

Even the single provision of the Council implementing the individual sanctions can be contested, in front of the European Union Court, pursuant to arts. 256 and 263 TFUE, for any incompatibility in the sanctioning measures with the binding principles of the community system. The appeal however recognises the limits set by art. 275 TFUE, regarding the PESC, excluding in any case the guarantees identified by UE regulation num. 269/2014 pursuant to art. 215(3) TFUE.

In truth a super yacht is like a proper business: with frozen funds, who and how is the yacht managed? Who pays for the expenses? Who is responsible for it after it has been seized?

Custody of frozen assets is given to the Agenzia del Demanio, who can in turn give management of the asset to a third party, with or without a tender. Management expenses, pursuant to art. 12 of Leg. Dcr. 109/2007 are covered by the Agenzia del Demanio through the withdrawal of the amounts levied on any basis. As a consequence, priority is given to frozen funds, but if those are lacking, the State will cover it with the right to recover the funds from the asset’s owner.

What happens to the crews?

There are no specific provisions regulating the implementation of freezing measures in detail, therefore the Agenzia del Demanio has ample discretionary power in evaluating the best manner in which to maintain the frozen assets.

It is known that large vessels require constant supervision and maintenance, which can only be guaranteed by qualified staff. We cannot exclude therefore that the Agenzia will decide to keep the current crew on board.

What happens from an insurance point of view (both for H&M cover and RCN or P&I)?

This is very complex and it is difficult to make a general evaluation, having to verify on a case by case basis with the wording of the policies and the nature and eventual cause of any accidents caused by the vessel that has been frozen.

Regarding H&M coverage (Hull and Machinery), the most common clauses in the insurance market often have exclusionary clauses regarding war, for example art 21 of the Yacht Institute Clauses which excludes cover in case of damages caused by capture, seizure, arrest, restraint or detainment.

The applicability of these exclusions could however be complex in this case, since the seizure was not implemented by a belligerent state. In addition, in order to apply a similar exclusion, the damage would need to be proven to have been caused by the seizure. A hypothesis could be, for example, damages caused by insufficient maintenance of the vessel which, however, may be excluded in this case due to another contractual clause regarding insufficient maintenance (for ex. art 9.2.2.2 of YIC).

The same can be said about coverage for civil responsibility within the YIC clauses, from the moment that the exclusion of the above-mentioned risks is the same as the RC section, being a paramount clause.

Often in body policy even more specific sanction limitation and exclusion clauses are imposed. This clause allows the insurer to refuse coverage in the case in which payment of the claim determines the violation of international sanctions, but a recent English case (Mamancochet Mining Limited v. Aegis Managing Agency Limited and others [2018] EWHC 2643 – Comm) have provided a rather restrictive interpretation of the cases in which the insurer can suspend (and not refuse) cover.

In P&I cover (Protection & Indemnity Clubs), clubs generally exclude indemnity for one-time claims regarding insurers or other subjects because of the possible risk of sanctions.

We also cannot exclude that the frozen vessels are insured using a specific war risk cover, which generally covers confiscation, seizures and other forms of asset detention by authorities. This cover could however include termination clauses in the case of conflict between certain powers like, for example Russia and the United States, and so in case a conflict occurs between these two countries cover could be withdrawn.

The s/y A, belonging to Russian oligarch Andrey Melnichenko, has been seized in Trieste by the Guardia di Finanza

Is a yacht under construction considered to be an asset that need “freezing”? Could sanctions also affect a vessel being built in a shipyard?

Certainly, a yacht under construction is an asset that can be frozen. In this case it would be important to ascertain whether or not the property of the yacht under construction has already been, even partially, transferred to the client: in the case in which the contract is under Italian law (the provisions of which are applied to the boat being built under Art. 241 Nav. Cod.),if the materials belong to the contractor, the property passes on to the client once the work is complete, but nothing stops, as often happens in practice, that the property is conventionally transferred earlier, for example at the end of certain construction phases (for ex. based on continuing works).

In contractual models used in international markets (for ex. Newbuildcon, Ship 2000) the property is generally transferred at the time of delivery to the client (protocol of delivery and acceptance). In the case in which guarantees are issued by the shipyard as a result of client payments, however, these may also be frozen, pursuant to art. 1, let. f) point 5 of Leg. Dcr. Num 109/07.

What can a shipyard do if it is building a yacht commissioned by a Russian client who cannot pay after several months?

This also depends on the construction contract. If the shipyard has asked and obtained from its client, bank guarantees for payment, it could proceed with prosecution, unless the guarantees have been issued by a Russian bank currently under sanctions, but this is improbable.

In absence of guarantees, the shipyard can recover the losses from the yacht under construction, unless it is a frozen asset. If the property of the yacht under construction has already passed on to the client, the shipyard could evaluate whether or not it can use a lien, a privilege or the possibility of obtaining a seizure, based on applicable rights.

Mega yacht

Mega yacht

Mega yacht

Mega yacht

Boating Marketplace

Boating Marketplace

Boating Marketplace

Boating Marketplace